Save Money

Save Money

Save Money and the Planet with Evergreen Power

12+ Years in Business

With over 12 years of experience since our founding in 2013, we have been a trusted leader in the solar energy industry. Our long-standing commitment ensures you receive reliable and innovative solar solutions.

Leading Accredited Solar Experts Across the UK

As one of the most accredited solar company in the UK, our MCS, NAPIT, EPVS, HIES, Trustmark accreditations guarantee the highest standards of quality and professionalism.

Thousands of Satisfied Customers

Having served thousands of satisfied customers, our focus remains on providing tailored solar solutions that meet unique needs. We've built a solid reputation for exceptional service and successful installations

1500+ Online 5-Star Reviews

Our over 1500 5-star reviews are a testament to our outstanding customer service and project execution. They reflect the trust and satisfaction of our clients. Join them in experiencing top-quality solar energy solutions.

About Us

About Us

Welcome To Evergreen Power UK

Your Specialist in Solar PV & Battery Solutions

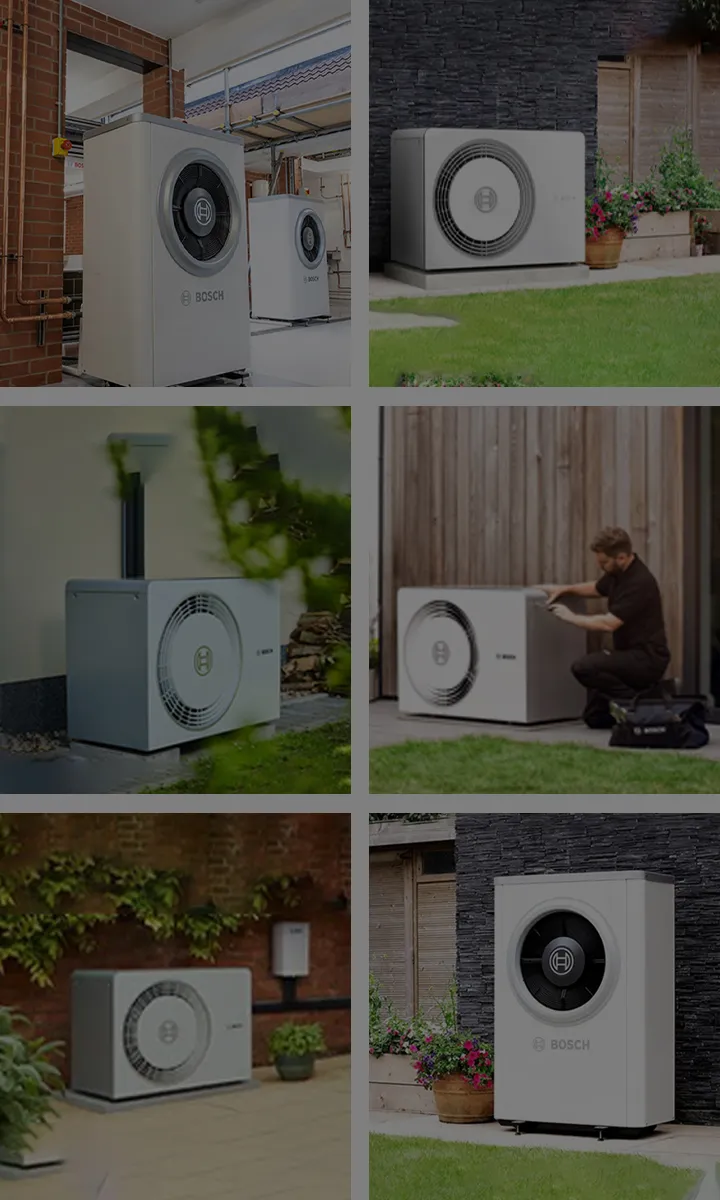

Evergreen Power UK specialise in solar panels and battery storage, heat pumps and air-conditioning systems—helping you save energy and reduce your bills.

Services We Offer

Services We Offer

Providing Solar PV Solutions Since 2013

Speak with a Solar Panel Experts?

Request a free quote now or speak with our energy-saving experts for impartial, personalized advice.

Why choose us

Why choose us

Evergreen Power

- Established Expertise: We started our business in 2013 and bring over a decade of experience and expertise to every project.

- Unbeatable Prices: Our commitment to offering competitive prices ensures significant customer savings.

- Price Promise: If you receive a lower like for like quote elsewhere, we guarantee to beat it.

- Customer Confidence: We love our customers, and they love us. Thousands of customers have rated us "Excellent". We pride ourselves on offering every customer a first-class customer service experience.

- Accreditations: We are highly decorated as Trustmark, BBA, MCS, NAPIT, EPVS, HIES Certified Installers, KIWA, and BAB accredited adhering to PAS 2030 and PAS 2035 Installation Standards, and certified under the Green Deal.

- Long-Term Assurance: Enjoy peace of mind with our workmanship warranty coupled to manufactures warranties.

Get in Touch Today

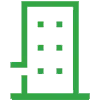

The Evergreen Way

Our nationwide operation is complemented by a local touch, and we're always just around the corner. Our teams possess a deep understanding of local dynamics and will tailor optimal solutions for your home.

Customer Service

We aim for every customer to have the best possible experience from sale to installation and beyond, every time

Accountability

We will never compromise on the quality of our service or products. For this reason, we never use subcontractors, and an in-house team of installers & electricians does all the work

Years of Experience

We put our customers at the heart of everything we do. We're friendly, easy to deal with and make you feel necessary to us (because you are!).

Customer Reviews

Over the years, we have done more than 25,000 installations & collected more than 1500 positive and few negative reviews

Learn More News & Blog

News & Blog

Latest News and Articles

Evergreen Power UK provides premium Solar Panel System, inverters, and batteries, helping homes and businesses switch to sustainable, cost-effective energy solutions

Eurosport Featured Video

Eurosport Featured Video

Evergreen on Eurosport

Frequently Asked Questions

Frequently Asked Questions

All Your Questions Answered

There can be considerable differences between the cost of different solar panels, but as with many household investments, it's worth remembering that when it comes to quality, efficiency and operation, you get what you pay for with solar panels. Most people find that striking the best combination of solar panel power output and roof coverage is the most cost effective way of investing in solar power.

How much do solar panels cost? A lot depends on the quality of materials used and the power output rating of the panels. Brands who use higher quality or more complex materials in their panels, or who offer higher capacity solar panels, are able to command a higher price per panel. But while they might seem pricey, they're likely to perform better in the longer term. Cheap solar panels, meanwhile, might seem like a bargain but might not deliver in the ways you expect.

Adopting solar panels UK can lead to significant savings on electricity bills. The extent of these savings varies based on factors such as the size of the solar panel system, energy consumption patterns, and the amount of sunlight your location receives. Most households can expect to reduce their annual energy costs by a substantial amount. For your specific circumstances, Evergreen Power UK can provide an estimate of costs saved during a home visit.

The size of your solar panel system depends on your energy usage, roof space, and specific needs. For homes, systems typically range from 3kW to 8kW, while businesses may require larger setups. Our experts will assess your property and recommend the best system to maximise savings and efficiency for your energy goals.

Most solar panel and battery installations from Evergreen Power are completed within one day, although there can be some exceptions due to adverse weather conditions, more difficult roofs or other technical complexities.

Solar panels require very little maintenance during their lifespan. Cleaning your panels and ensuring they are not covered can help you get the most out of your panels. Scheduling regular checks, biannually can help spot any damage sustained by your solar panels.

Yes, in the UK, solar panel installations benefit from VAT-free pricing for most homeowners, making solar more affordable. Additionally, you can earn money through the Smart Export Guarantee (SEG), which pays you for the excess energy your system exports to the grid. Our team can guide you on how these incentives apply to your installation.

Get a Quote, or Learn More.

Ready to take the next step? Contact us today for a personalised quote and see how we can help meet your needs.

Have questions? Visit our full FAQ page for detailed answers to the most common inquiries.

Get a Free Quote

020 3793 7323

020 3793 7323